|

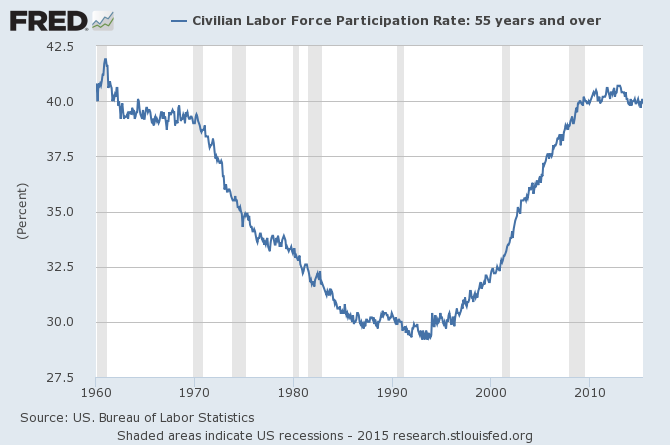

PEOPLE AGE 55 AND OVER For the work force 55

years and over, the LFPR is quite different from that of earlier

ages. The LFPR of this group declimed from about 43% in the early

1950's to a minimum of about 29% in early 1990's. Since then,

it has been rising and continued to rise during the recession.

Now [5/15] it is about 40%. One explanation is this: "Perhaps

older Americans are being forced to work more because they have

not saved enough for their retirement. This lack of savings may

be a result of the recent economic trends in America: stagnant

wages, depleted retirement portfolios (from the 2008 financial

crisis), and rising health care costs." [http://bpr.berkeley.edu/2013/04/the-declining-labor-force-participation-rate-why-this-trend-should-be-taken-seriously/]

The age at which workers are eligible for full Social Security

benefits is rising and will affect the choices available especially

to those 62 and over. With a later age for full retirement benefits,

those retiring earlier will suffer a larger decline in monthlybenefits.

LFPR

WORKERS 55 AND OVER 1950 to May 2015

Zero

Hedge reports that since the "recovery," virtually

all job gains have gone to older workers... April [2015] merely

confirmed this demographically disastrous trend, and of the 255K

workers added in the household survey when broken down by age

group, more than all, or 266K went to workers aged 55 and older.......increasingly

old Americans are forced to work well into their retirement years

not because they want to but because they have no choice, thanks

to the Fed's ZIRP policy which has destroyed any retirement value

their savings may have had." According to the Ctr

for Retirement Research, "declines in housing wealth

during the Great Recession lowered [estimated] retirement probabilities

of married males by as much as 15 to 19 percent. This delay

was offset in cases where the household had defined benefit or

defined contribution pensions."

"Today, more than half of working households

do not have enough assets to avoid a drop in consumption in retirement,

according to analyses by Alicia H. Munnell from Boston College

and her colleagues. The proportion of households in that group

has increased by 10 percentage points in just the last 10 years."

Porter, "Doing More, Not Less, to Save Retirees From Financial

Ruin," NY Times, 6/16/15

Low-wage

Workers: Still Older, Smarter, and Underpaid, Bucknor, CEPR

5/15

|