|

Social Security, the government program that has extended modest

security to generations of Americans of all ages, is under attack.

Unable to destroy a successful and popular program directly, conservatives,

who have fought it since its inception in 1935, tried unsuccessfully

to privatize it during the Bush Administration. Now they make

the false claim that it is financially unsustainable. This argument,

which began during the Clinton era, has accelerated as government

deficits rose as a result of a number of factors other than Social

Security: high unemployment and consequent decline in revenues,

a bloated military budget, the Bush-era tax cuts, and a mostly

private medical care system that is largely publicly funded,

one far more expensive than those of other industrial countries.

Surprisingly, many liberals, perhaps misinformed of the actual

condition of Social Security, now believe that a crisis is inevitable

unless changes are made that will one way or another reduce benefits

and living standards.

The articles in this packet show that Social Security is financially

sound without any changes whatsoever, that it serves a far larger

population than only retirees, including many disabled persons

and the families of retired and deceased and disabled persons.

And any changes made in Social Security should expand its protections,

especially as private pensions wither. [1]

The articles:

- Expose the phony Social Security "crisis" by

showing that Social Security is fiscally sound, able to support

a growing elderly population, is not a source of the deficit,

and that the Trust Fund is safe. [Fund revenues come from payroll taxes on employees, their employers, and the earnings of the self-employed, and expenses and payments to SS recipients come out of the Fund. The excess of revenues over payments is accumulated in the Fund, in the form of special Treasury bonds, and can be tapped if a year's payroll taxes are insufficient to pay recipients.]

- Show how Social Security benefits the entire U.

S. population, reduces poverty, and is especially important

not only to the elderly but also to children as well as to women,

minorities and other lower-wage workers.

- Explain why reducing Social Security for future retirees

is not only unjust and unwise, but is unnecessary.

- Point out how Social Security can both remain fiscally

secure and be strengthened.

There Is No Social Security "Crisis":

Social Security Is Fiscally Sound

Many reports on the Social Security Trust Fund treat projections

by that system's actuaries as fact rather than the best estimates

that can be made at the time. The projected Fund exhaustion in

2033 [2014

SS Trustees Report,p.3] then is taken to require immediate

action to raise SS taxes or reduce benefits.

How are these projections derived? The Trust Fund actuaries make

three sets of estimates, called "intermediate," "low-cost"

and "high-cost," with the intermediate used as the basis

for best estimate of Fund exhaustion. For example, the intermediate

projections are based on assumptions which, compared to low-cost

projections, will lead to Fund exhaustion at an earlier year.

These more conservative assumptions would include slower economic

growth, higher unemployment rates, and lower mortality rates.

Under these intermediate assumptions, which the Trustees

report to the public every year, the Fund is slated to be able

to pay all expenses until 2033. Even

after the Fund is exhausted, payroll tax collections would be

sufficient to pay recipients 77% of the higher benefits due

then, according to the Trustees [See

2014 Annual Report of the Trustees, p.11]. By contrast,

problems of climate change are here already, but far less discussed

and planned for by the Congress.

The highly variable projections of the Trust Fund undermine the

case for immediate action. The projections below are based on the yearly

Social Security Trustees Reports. They use the "low-cost"

projections because these include assumptions of output growth

which are closer to our historical experience than those of the

"intermediate" projections. [Even so, our actual growth

rates over decades exceed the low-cost assumptions. For example,

the low-cost projections of the 2014 Report assume the economy will grow at a rate

of 2.85% over the period 2014 to 2090. We experienced average growth of

3.10% between 1960 and 2013.]

The following projections are from Trustee

Reports for 2011, 2012, 2013, and 2014, all in constant [year of report] prices.

- 2011 Report: the Trust Fund is projected to be $17.5 trillion

in 2085 and rising;

- 2012: the Fund is $1.2 trillion in 2090; declining after 2025,

then rising again from 2075;

- 2013: the Fund is depleted by 2068;

- 2014: the Fund is $6.4 trillion in 2090, and rising.

In each year's projections, except for 2013, the Trust Fund is

rising because each year, Social Security's income exceeds the

total costs of paying beneficiaries. In 2090, for example, the

Trust Fund, at $6.4 trillion, is enough by itself to pay all costs

in that year [$5.7 trillion].

Because the Trustees Reports have the highly variable predictions shown above, it seems unwise to base current policy on such variable

estimates, especially at a time when the majority of people are

still suffering from the continued effects of the fiscal crisis.

Rather, it seems best to leave Social Security unchanged. SS has been billions

in surplus, including interest on the Trust Fund, even during

the crisis. [See Table

IV.A3.] If, in the unlikely event its usual yearly surpluses are no longer generated,

then will be the time to increase taxes. Its funding needs can

then be easily met by raising the income cap on the payroll tax.

Further, SS works best as a pay-as-you-go program: the needs

of the future cannot be funded by taxes now. The necessities of

the future must be produced then with the workers, machines, and

technology available then. What our economy should do now to prepare

for the future is to invest in these resources, so that we can

meet the needs of people in the future. Piling up monetary surpluses

can't meet future needs. [See "What Really Supports the Elderly?]

There Is No Demographic

"Crisis" [See Social

Security Is Not In Crisis]

There is absolutely no demographic problem with

Social Security. Those who insist there is one make what is to

them an obvious connection between the falling number of workers

to retirees and "inevitable" Social Security shortfalls.

However, compared to times when there were many more workers per

retiree, say 1960, it takes fewer farmers to grow a bushel of

wheat; fewer bakers to bake our bread; fewer mechanics to make

a car, and fewer technicians to build a computer. Result? Fewer

workers needed to support a retiree. Were this not true, a poor

country like Bangladesh, with many workers and few retirees would

be far better able to support its retirees than a rich country

like the US.

The ability of a country to support the population who are not of

working age--the young and the elderly--depends on its productive

capacity as well as the size of this dependent population.

In 1960, when the United States was shouldering the responsibility

for both the baby boomers and the elderly, its Gross Domestic Product

(GDP) per capita was only 35%

of what it was in 2013, adjusted for inflation. At the time when the "crisis"

crowd says we'll have too many dependents to take care of, this

nation should be much wealthier

than we were during that earlier period of high dependency.

We are wealthier because our workers, made more productive by

their education, tools and better health, produce more. It is

not merely numbers of workers per dependent that count. It is

productivity--the output that each worker can produce--that determines

our prosperity. Moreover, the baby boomers and the elderly combined

were larger in proportion to the working-age population than the

comparable group will be later in this century. It is absurd to

think that a nation as rich as the United States cannot provide

security to all.

Rising productivity also permits higher wages on which taxes

are levied to fund SS benefits. The policies of the last

few decades do put SS at risk--the lag in productive investments

at home that improve our means of production; the political failure

to insist on policies that aid in ensuring that higher wages follow

productivity improvements; and rising inequality, which limits

the wages subject to SS taxes.

The Social Security Trust Fund Is

Safe

Many conservatives warn future beneficiaries that "there

is no Trust Fund; just IOU's" [as former President Bush said at the Bureau of the Public Debt], implying that the government might renege

on its debt. Yet government IOU's, held by the Chinese and other

governments, foreign corporations, and foreign investors are funding

our enormous trade deficit. Would we wish to convey to these bond

holders that our government is an unreliable debtor? The government

has never defaulted--why should it just for the Trust Fund bonds?

Social Security Benefits and Protects the Entire Population

[see Facts about

Social Security 2014, Social

Security Is Not Just for Seniors and

Quiz:What's in it for Younger People?

Social Security benefits all age groups--young

workers who have insurance for death and disability during all

of their working years, retired workers, disabled workers and

their dependents, and the survivors of deceased workers.

Twenty

million Social Security beneficiaries

[2013] are not retired workers —they

are workers with disabilities, children of retired, disabled,

and deceased workers, spouses, and care-taking parents. Children

get more

benefits from Social Security [p.4] than from any

other federal program.

- Before Social Security, the groups that are now covered--working

men and women, seniors, widows, orphans, and disabled persons--had

neither insurance nor savings. Those were the days of social

insecurity.

- Social Security protects the elderly at all income levels,

and for all but roughly the

wealthiest one-third of seniors,

it is their principal income. Unlike most pensions, it

is inflation-adjusted, and unlike 401k's, it lasts for the retiree's

lifetime.

- Social Security relieves adult children of much of the financial

strain of supporting their aging parents and gives parents the

dignity of an assured income of their own.

Social Security Prevents Poverty

Without Social Security, about

44% of all seniors

[2012] would be living below the government’s official

poverty level rather than the actual 9%.

-

In 1959, when poverty measures began, 35%

of Americans 65 and over were living below the official poverty

level. Seniors were then the poorest age group in the population.

Thanks largely to Social Security, the elderly are

now the age group with the lowest poverty rate [about

9% in 2012]. Of course these

poverty standards for all groups have lagged behind changes

in the standard of living.

Social Security Benefits Women, Minorities

and other Low-Wage Workers [See "Women

and Social Security", and "Social

Security and Minorities"]

-

Because they face discrimination and often

lack health care and other resources, groups such as African

Americans have lower life expectancies than other groups.

Consequently, they are more likely than less-disadvantaged

groups to need Disability and Survivors’ benefits.

-

Women, minorities, and other lower-wage

workers who are less likely to have private pensions or assets,

depend more heavily on Social Security than higher-income

workers. In fact, higher-wage workers, too, are increasingly

likely to be without employer-financed pensions, so Social

Security will become even more important for them as well.

-

Owing to more risky jobs, less access to

health care, discrimination, and poverty, lower-income and

minority workers have higher rates of disability. Consequently,

they are more likely to depend on disability benefits than

more privileged groups.[2]

The Continuing Threat to Social Security

In 2010, President Barack Obama appointed a commission to study

the deficit. The Chairs of the National Commission on Fiscal Responsibility

and Reform [the Deficit Commission] proposed remedies to the Federal

deficit that include raising the retirement age and cutting benefits

for all but the poor. Obama's Transition team

Social Security advisers called the Commission “a

Social Security death panel.”[3] Nonetheless, the recommendations

of the Deficit Commission are still popular among some officials

as a basis for cutting the deficit.

Strengthening Social Security

Increasing public investment to maintain and

increase productive capabilties, ensuring that all who want a

job can have one, and ensuring that wages regain and surpass earlier

peaks will provide a strong economic foundation for financing

Social Security and other social programs. In short, this is the

proposal of the National Jobs for All Coalition--to bring

together workers needing good jobs with our unmet social needs.

This is the basis for a strong, productive economy which would

serve our needs and permit more generous Social Security benefits

in response to the diminishing provision of private pensions.

[See

Social Security Is an Anti-Poverty Program.] Rising inequality,

which has put more income beyond the maximum at which SS

taxes are paid and enlarged the fraction of income received as

interest, profits and capital gains, which are not taxed at all,

has also restricted Trust Fund revenues.[4] Wage lag has also reduced

taxes that would otherwise be paid to the Trust Fund.

Jobs for All at living wages is the best economic

insurance for Social Security because it means more people make

higher contributions and fewer people collect benefits. This is

the basis for tapping the financial resources of the productive

economy described above.

In addition to the economic foundation for Social

Security, we need the political will to use our abundant resources

for the national social and economic welfare.

Prepared by Social Security Task

Force: Robb Burlage, Eleanor Kremen, Helen Lachs Ginsburg, Laura

Piil, June Zaccone, Editor, Gertrude Schaffner Goldberg, Chair,

July 18, 2001

Revision and update September 2014 by June Zaccone. Thanks to

Helen Ginsburg and Trudy Goldberg for their comments.

[1] "The share of workers with traditional pensions is down

to about 15 percent. The rest either have no pensions or have

401k plans that are not pensions at all. 401k's, like IRAs [Individual

Retirement Arrangements] and Keoghs [tax-deferred pension plans

available to the self-employed or unincorporated businesses],

are tax-sheltered savings plans. More than half of people between

55 and 64 have no pension and no retirement plan at all other

than Social Security." Kuttner,

4/13

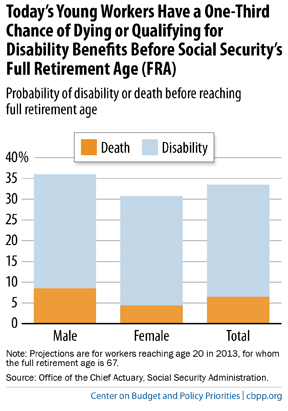

[2] "The risk of disability or early death is much greater

than most people realize. About 39 percent of young men and 31

percent of young women will die or become disabled before they

reach retirement age, according to the Social Security actuaries.

Social Security’s life and disability insurance helps prevent

poverty among families that suffer these losses. For example,

a 30-year-old worker earning about $27,000 to $33,000 in 2008

with a spouse and two young children had Social Security disability

and life insurance protection valued at over $450,000 each. "

Social

Security Is an Anti-Poverty Program, By Ben Veghte &Virginia

P. Reno, National Academy of Social Insurance (NASI), 5/10

Source: http://www.cbpp.org/research/chart-book-social-security-disability-insurance?fa=view&id=4169

[3] As mentioned before, the deficit results from continuing

joblessness, a military budget approximating those of the rest

of the world combined, and the Bush tax cuts. These are still

not adequately addressed, though the deficit has fallen as the

economy slowly expands again. The Administration appointed the

two co-chairs: former Wyoming Republican Senator Alan Simpson,

and Erskine Bowles. Simpson described seniors writing to him about

Social Security as “These old cats 70 and 80 years old ....who

live in gated communities and drive their Lexus to the Perkins

restaurant to get the AARP discount." Bowles, who is a director

of Morgan Stanley, a Wall Street bank saved by the taxpayer bailout,

says, "We’re

going to mess with Medicare, Medicaid and Social Security

because if you take those off the table, you can’t get there."

As Clinton's Chief of Staff, he "cut

a deal with Newt Gingrich that would have partially privatized

Social Security in the 1990's if the Monica Lewinsky scandal hadn't

derailed their plans." Eleven of the 18 Deficit Commission

members are known supporters of privatization.

[4] "This upward redistribution is important to Social Security for two reasons. First, it has shifted a large amount of wage income to workers earning above the cap. The share of wage income that has escaped taxation in this way rose from 10 percent in 1983 to 18 percent in recent years. Similarly, the shift from wage income to profits in the last 14 years has also deprived the system of revenue. The other reason this shift is important is that it has kept wages from growing in step with productivity. If the typical worker's wages had risen in step with productivity since 1980 they would be more than 30 percent higher today." Dean Baker, Sept 2014

©The National Jobs for All Coalition

|